NOTE - Page will be updated when new dates are announced

Valuation Protest

If you feel that your real estate is currently over valued by the county, we offer services in determining the market/equalization value relative to the assessed value. The process starts with filling out a Protest Form and supplying reasoning behind your protest. Unless you provide evidence to the contrary, the law requires the assumption that the assessment is correct (State Statute 77-1502).

NOTE: Referees will not hold face-to-face hearings with protestors.

Determining if your Assessed Value is correct

There are two arguments for protesting valuations.

1) Your property is overvalued based on market value.

On the basis of market value, recent sales of comparable properties from the same neighborhood or similar markets can be used to demonstrate the legitimacy of your argument. Age, Condition, Size, ETC all play a role in adjustments. Use sales of properties that require the least amount of adjustments when comparing them to your property. The more adjustments used - the less reliable the data is.

Take photos of your property - specifically of deferred maintenance (repairs that have been put off) and structural damage. Include an estimate of the repair work with the pictures from at least two different contractors.

An appraisal of your property from a licensed appraiser is the best source for fighting assessed values. NOTE - appraisers are not advocates like attorneys. Your appraisal may in fact support the assessed value and not your opinion. Appraisals are a third party opinion from an uninterested party regarding market value of the subject property. We do not recommend an appraisal for properties where the assessed value and your opinion of what it should be is <$250,000 (Commercial) $75,000 (Residential).

2) Your property is overvalued based on equalization. Simply put this means that your property is not aligned with competing properties assessed valuations.

Fighting your assessed value on this basis requires finding similar properties in your neighborhood and comparing assessed values (not sales) based on Age, Condition, Size, ETC. We recommend using a basic spreadsheet layout with as much data as possible.

| |

Important Dates

June 1 - First day to file protest

June 2 - First day to hand deliver protest

June 30 - Last day to file protest

On or about August 10 - BOE convenes and determines property valuations on protested properties. Results sent to property owners within 7 days of determinations.

September 10 - Last day to file protest with TERC

|

Appeal

If you are not happy with your initial valuation protest, you may appeal to the TERC (Tax Equalization and Review Commission) and have your case presented. The TERC board is made up of 4 Governor appointed members whose main duty is hearing appeals of assessed valuation protests. Appeal Form

After completing the form, there will be an informal hearing where you present your case. Do not appeal unless you have a solid basis for doing so and have material ready.

Arguments that DO NOT Work

1) I cannot afford to pay these taxes. The County Assessor and TERC are not concerned about your ability or inability to afford your property taxes. They are concerned with the relationship between market value and assessed value.

2) How could my property double in valuation in one year? The County Assessor and TERC are not concerned about the past, they are concerned with the correctness of the assessed value as of today.

All decisions are now made part of public record. Research recent appeals as much as possible before proceeding. Decisions

Useful Articles

Check Your Valuation with Curbwise

A new site from The World-Herald, Curbwise.com lets you see your valuation before it's mailed out by the Assessor's Office. The site also shows sales trends and information about your neighborhood.

Property taxes going up in Douglas County after building commission approves increase

By Christopher Burbach / World-Herald staff writer

May 30, 2018

The Omaha-Douglas Public Building Commission approved a property tax increase Tuesday that a commission member called “minimal” and a taxpayer advocate called “avaricious.”

The proposal calls for the building commission’s levy to go up from 1.5 cents per $100 in valuation to 1.7 cents. That would result in a $2 annual increase on a $100,000 home.

https://www.omaha.com/news/metro/property-taxes-going-up-in-douglas-county-after-building-commission/article_330c285f-cb46-5499-955d-d1bc09ebd303.html

Metro Area Home Values Flat

The Wakonda area in northeast Omaha has seen changes over the years — white flight to the suburbs in the 1960s and 1970s, increased numbers of rental properties, an aging and dwindling population.

Now the Douglas County Assessor's Office has weighed in with its own take on the homes north of Sorensen Parkway between 42nd and 60th Streets. The county is dropping property valuations this year for 43 percent of the houses in the area.

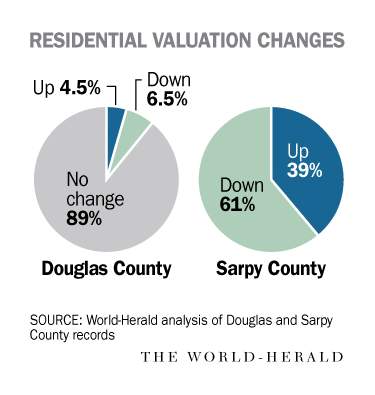

Those valuation cuts stand out in the latest round of property assessments, which are largely flat in Douglas and Sarpy Counties.

In Douglas County, eight out of nine homeowners will see no change in valuations. In Sarpy, nearly all valuations are updated, but the changes are slight. Two-thirds of all Sarpy home valuations will go up or down less than 2 percent.

In both Douglas and Sarpy, more homes were reduced than increased this year — which was also true in 2010. This year's cuts, however, tend to be smaller than last year's as the real estate market begins to rebound.

“Locally, they're slowly coming back,” said Sarpy County Assessor Dan Pittman.

31% of Valuations Topped Sale Price

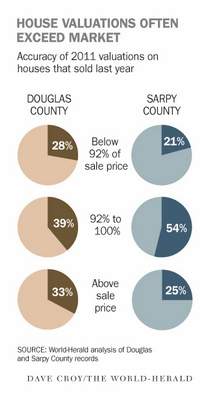

Three out of 10 homeowners in Douglas and Sarpy Counties might be paying more than their share of property taxes, according to a World-Herald analysis of property valuations and recent sales.

The analysis suggests that county assessors might have been able to lower valuations more this year because of weaknesses in the local real estate market. And it indicates that thousands of homeowners might be able to make a case for lower valuations during Board of Equalization protests in June.

“Those are the ones that are going to come in and protest,” acknowledged Douglas County Assessor Roger Morrissey. “The protest period is for those to come and show us where we're wrong.”

Foreclosures Affect Valuations

Sanjeev and Bhawana Rathore bought this house near 168th and V Streets in a foreclosure sale last October for $189,000. Now they are protesting its $247,600 tax valuation set by the Douglas County Assessor's Office.

Shattered shingles, gashed gutters and tattered tiles — Sanjeev Rathore says his suburban Omaha home has it all, and then some.

The 34-year-old purchased the house in the Mission Hills neighborhood, near 168th and V Streets, in a bank foreclosure sale last October. He and his wife, Bhawana, 35, knew it was a fixer-upper and paid $189,000, much less than the price of other neighborhood homes.

Now the Bathores are protesting the $247,600 tax valuation set by the Douglas County Assessor's Office.

“Initially, the bank put it up for the assessed value, and no one bid on it,” Sanjeev Rathore said. “So what does that say about the assessed value? It doesn't speak to the market.”

Weaknesses in the housing market could drive protests this month to county boards of equalization across Nebraska.